Recovery comes at different speeds in the hotel sector

Encouraging data from the Hotel Sector Barometer in Spain prepared by STR and Cushman & Wakefield. For the first time since the first quarter of 2020, the third quarter report offers an optimistic view of the sector with an upward trend.

The most relevant data of the report are detailed below:

The vaccination process and the disappearance of most of the restrictions on mobility have allowed the hotel sector to increase its activity and begin the process of a recovery that will be faster in the holiday sector.

The comparison between September 2020 and September of this year is the best symptom of this recovery, as the indicators for Spain as a whole are soaring, also taking into account that the indicators include data from all inventoried hotels, both open and closed (Total Room Inventory).

Occupancy stood at 49% in September, more than three times the 16% of September last year. RevPAR also grew by 369% to €56, while ADR reached €114, 52% higher than in 2020.

This increase in activity has its peak in the Balearic Islands where it has reached 44%, an increase of 577% compared to September last year.

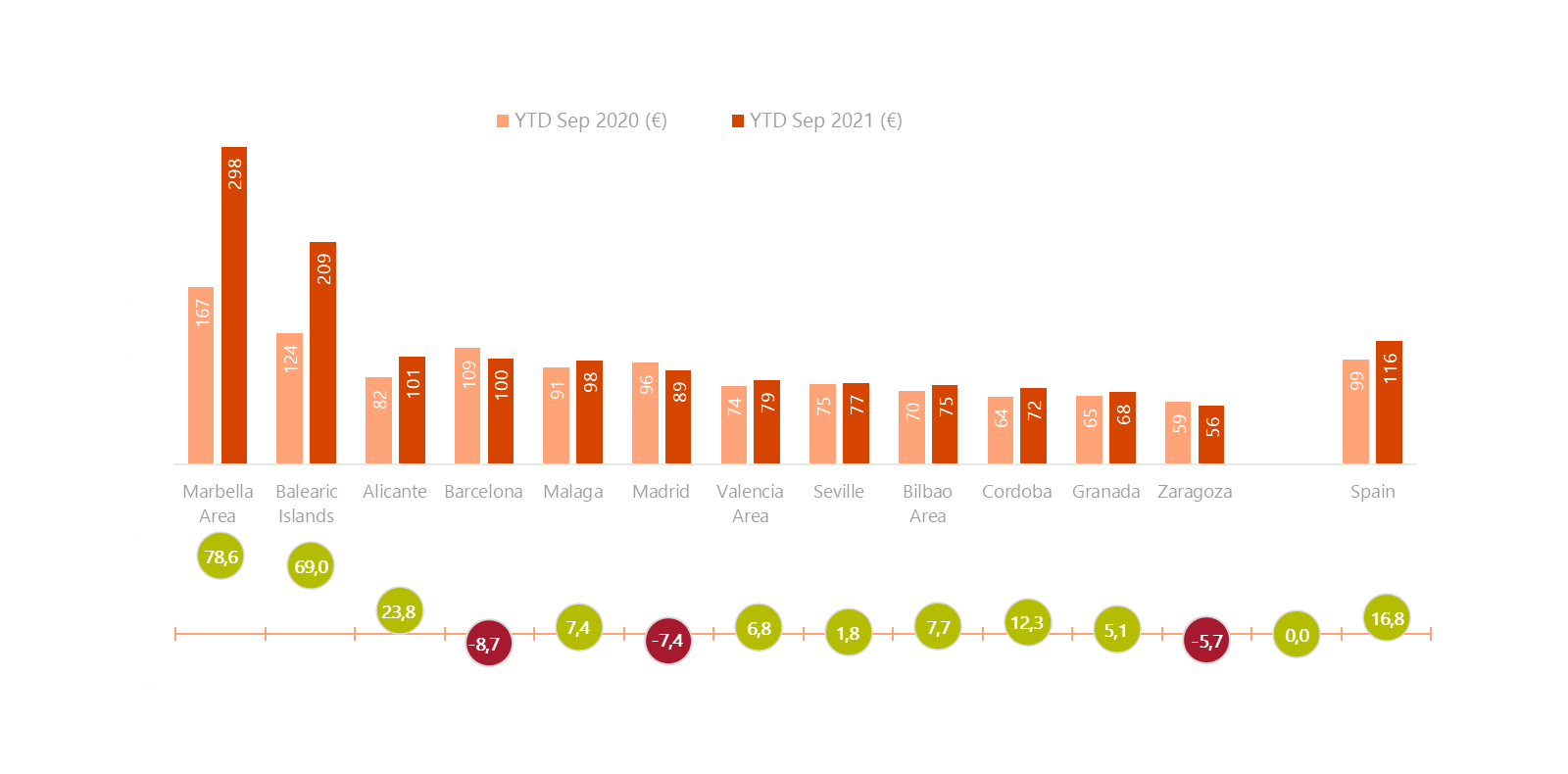

Occupancy reached 26% during the first nine months of the year.

The cumulative occupancy figure for the first nine months of the year reached 26% of the total number of hotels, both open and closed, during the first nine months of this year. Although this figure represents an increase of 20% compared to last year, we are still far from the usual occupancy rates prior to the pandemic. For example, in 2019, occupancy during the first nine months was 76%.

The highest occupancy from January to September was recorded in Malaga (44%), Zaragoza (44%) and Alicante (42%). In Madrid it reached 27% and in Barcelona 25%. On the other hand, the lowest occupancy was recorded in the Canary Islands (19%), as a result of air traffic restrictions, and in the Balearic Islands (20%), where seasonality is also high.

However, data from the Balearic Islands in September already show a significant change with an increase in occupancy of 577% compared to September 2020.

For César Escribano, STR Country Manager for Spain and Portugal, "this summer has undoubtedly been the summer of hotel recovery, especially in holiday destinations where we have seen occupancy and profitability levels close to or even exceeding 2019 levels in the month of August, with domestic travellers being the real protagonist of bookings, especially in coastal destinations, where occupancies reached 90% and profitability levels (RevPAR) similar to those of 2019. Furthermore, according to our data, the propensity to travel is on the rise, so we are finally predicting a good winter season for the Canary Islands at pre-pandemic levels".

Bruno Hallé, partner and co-managing director of Cushman & Wakefield Hospitality in Spain, said: "The barometer indicators help us to point out trends, but we have to take with caution the comparative data with 2020, which was a practically inactive year since March. From now on, the industry must work to recover the segments, both holiday and urban, and do so with a reasonable pricing policy that boosts activity without losing value or putting at risk a tourism brand that is a world leader like Spain".

OCCUPANCY - COMPARATIVE THIRD QUARTER 2020-2021

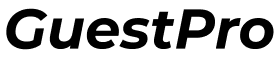

ADR stands at 116, 17% higher than in the first nine months of 2020

The lack of visibility during the more than a year and a half that the pandemic has lasted is an element of pressure on the pricing policy of hotel companies.

However, the data show that the hotel industry has been able to withstand this pressure and, during the first nine months of the year, the ADR has stood at €116, 17% more than during the same period last year.

Looking back, the ADR for the first three quarters of 2019 was €120, which is almost at the pre-pandemic level. It stood at €88 for the first six months, slightly down from €91 last year.

The highest prices per room were found in Marbella (€298), the Balearic Islands (€209), the Canary Islands (€115) and Barcelona (€100). For its part, the ADR in Madrid stands at €88, although the September figure (€105) seems to augur a reactivation of the destination in the coming months. The lowest prices per room are in Zaragoza (€56) and Granada (€68).

For Albert Grau, partner and co-head of Cushman & Wakefield Hospitality in Spain, "hotel operations have recovered in the summer and, if the pandemic remains under control, we will see hotel prices also rise to 2019 levels. Energy price pressures are also important for the sector, so a reasonable pricing policy is needed as demand recovers".

ADR - THIRD QUARTER COMPARISON 2020-2021

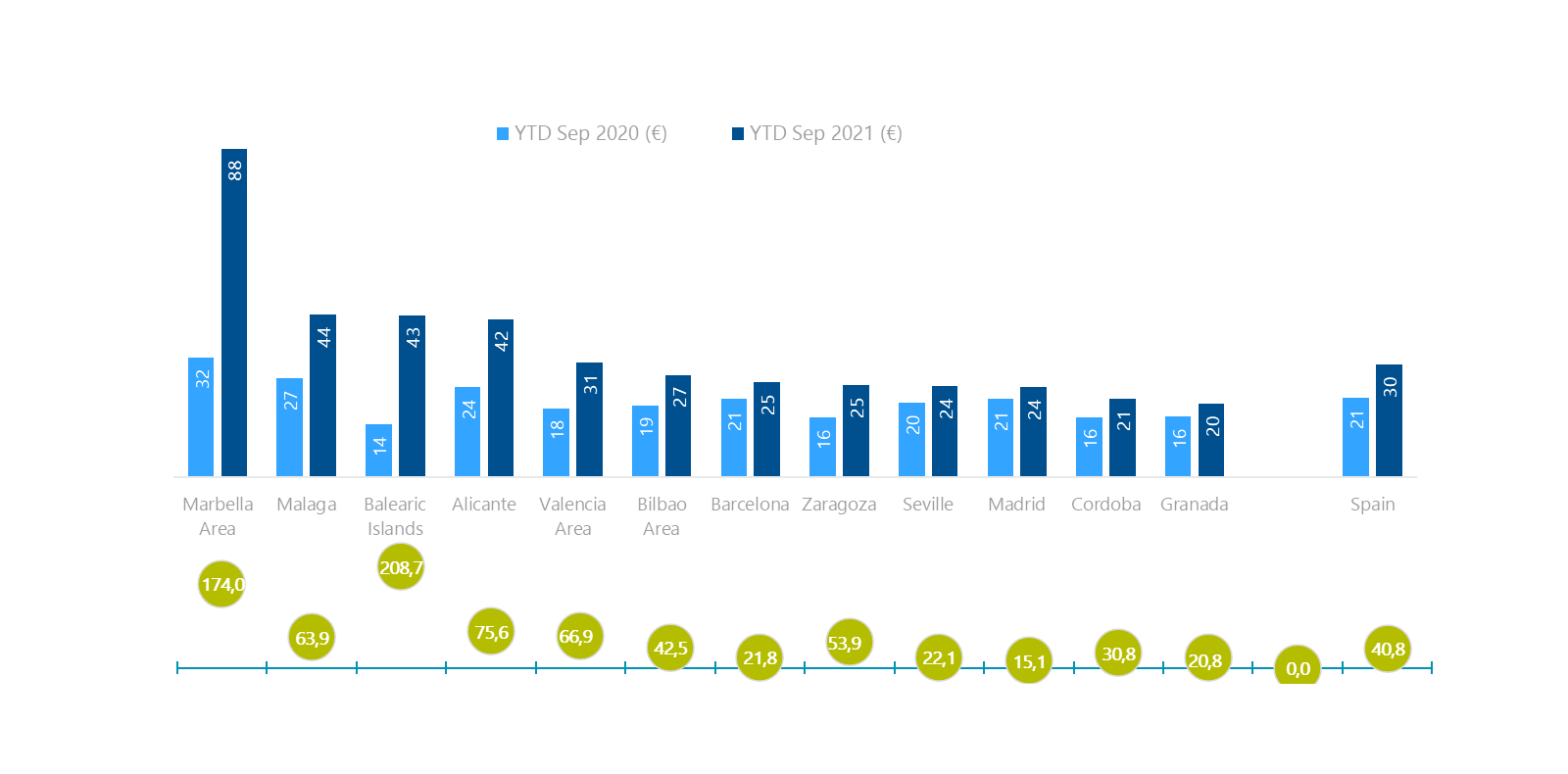

RevPAR exceeds €30 from January to September, 41% more than last year.

Revenue per available room (RevPAR) has reversed the trend of recent quarters and, with the arrival of summer, has managed to exceed the average of €30 in Spain as a whole. In September alone, the RevPAR has already reached €56, which shows that the pace of activity is clearly recovering. The highest RevPARs in the first nine months of the year were in Marbella (€88),

Balearic Islands and Malaga (43€ in both). At the lowest level are Granada (€19), Cordoba (€21) and the Canary Islands (€23). For their part, Madrid and Barcelona reach €24 and €25, respectively, also on an upward trend with respect to 2020.

RevPAR - COMPARATIVE THIRD QUARTER 2020-2021

The Hotel Sector Barometer is elaborated according to the data collected from 1,200 hotels and around 150,000 rooms in the Iberian Peninsula. The report is produced thanks to the collaboration between STR, a global provider of benchmarking, analytics and market knowledge, especially in the hotel sector, and Cushman & Wakefield Spain, a leading global real estate services firm.